🔺 CDC 3200 computer operator panel (all binary and octal)

The CDC 3200, a basic octal/8-bit mainframe, was used by the US government (eg IRS), Defense (eg Vandenberg ICBM launch control) and universities. It was also used by Canada's Defence Research Communications Establishment, Ottawa, and by MacDonnell Aircraft for "man in the mission" simulation of Gemini missions. At CDC the tech environment included disk stacks with MSOS (Mass Storage Operating System) and mag tape storage.

At that time Lloyd was also programming IBM System/360, a (hexadecimal/16-bit) mainframe used by NASA for critical scientific and space exploration tasks, including the Apollo program, Deep Space Network, and early missions like Mariner 10 and Voyager.

🤔 Lloyd's machine language experience was applied to the first microcomputers (Zilog Z80 in the Cromemco Z-1, Intel 8080, and Motorola 6502 in the Apple II). In addition to maths and administrative applications, Lloyd built some interactive computer games for technology demonstration purposes to RAAF and Navy officers (eg at the RAN Staff College).

🤔 As more languages (compilers) became available, Lloyd was programming in BASIC, COBOL and FORTRAN in Hewlett Packard and Prime minicomputers, service bureaus, NSWIT/UTS ICL 1904 mainframe to statistical and modeling products and the internet. At that time BASIC had no apparent limit on the number of dimensions in an array, which was great for his development of Mathematrix (academic use only: eg transport model optimization - nowadays these problems are sent as a QUBO to a quantum computer).

🤔 Lloyd was engaged by Dr Robert Graham, head of the UTS graduate program, to develop code for evaluation of mining licences, using time sharing service bureaux via a Texas Instruments Silent 700 terminal.

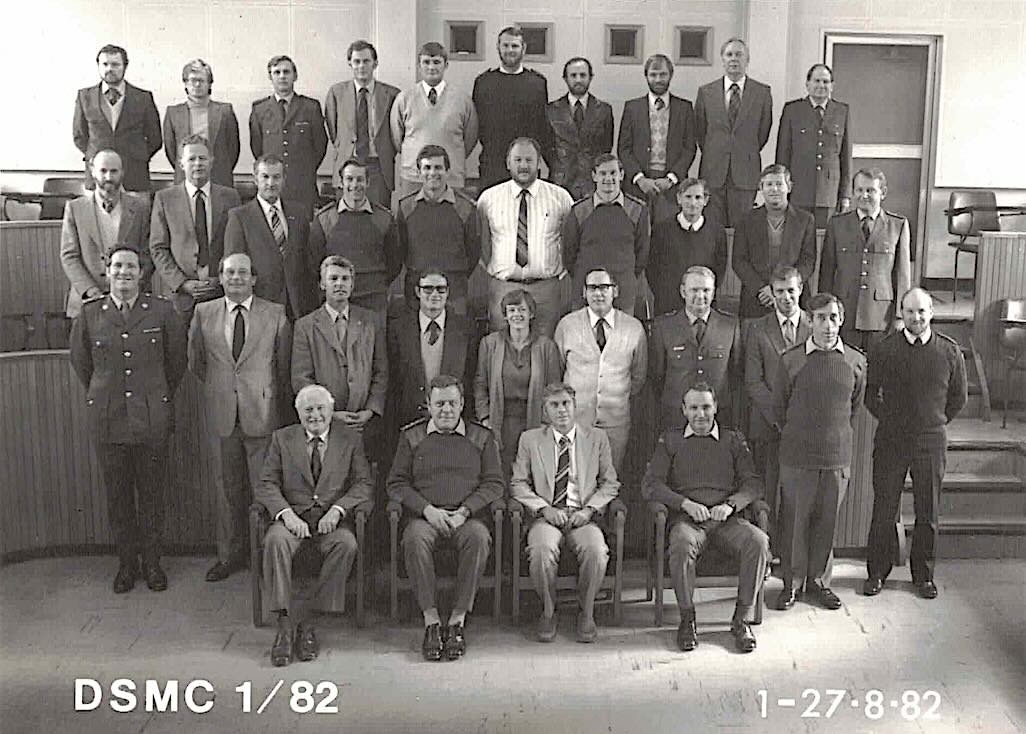

⚔️ Defence Systems Management Course [DSMC 1/82]

🔺 DSMC 1/82: The first Defence Systems Management Course

The course was run by Defence Science and Technology Organisation (DSTO) for Lieutenant Colonel and Colonel equivalent officers. The 4-week residential course was about development of defence strategy and capability requirements amongst other related issues. Lloyd was selected to attend the first of these courses.

👨🎓 Business Education: BBus (Accounting), MBA (Investment)

University of Technology Sydney (NSWIT) Lloyd was the first student enrolled in the NSWIT/UTS first UTS (NSWIT) MBA course:

- Bachelor of Business 1981 (by coursework): Management, economics, accountancy, business law (company law, tax law etc).

- Master of Business Administration 1984 (by coursework, thesis and research project): Investment [High Distinction]

Master's thesis and research project: Predictive optimum portfolio construction, including construction of a portfolio model based on Elton, Gruber and Padberg's Optimum Portfolio Selection Criteria, written in BASIC for an early IBM PC fed with daily files of whole of ASX market stock price data from IP Sharp, which was purchased by Reuters in 1987. The project supervisor, Dr Zoltan Matolcsy, had been head of research at the Sydney Stock Exchange, which was later amalgamated into the ASX on 1 Apr 1987.

- Company Director Diploma, University of New England This was the first company director's course and Lloyd became a Fellow of the Company Director's Association. When CDA merged with the Institute of Directors to form the Australian Institute of Company Directors Lloyd became a Foundation Fellow of the AICD.

PROJECT MANAGEMENT

Lloyd has worked on major high technology projects for the Federal government, the Australian Defence Force, and aviation and banking sectors.

🤔 While working in Defence, Lloyd developed the application of Monte Carlo simulation for risk identification, assessment and management of multiple potential critical paths in major defence acquisition project networks (with CMDR John P. Jenner [Seahawk pilot, and the Navy's first Director of Naval Integrated Logistic Systems Management] and WGCDR Terry O'Brien). Prime Computer provided their Canberra laboratory and Execucom provided their IFPS software. The MCPM demonstration project was the construction of a fleet of mine hunters.

Nowadays one might be inclined to present this problem as a QUBO (Quadratic Unconstrained Binary Optimization) problem to run on an Amazon Web Services (AWS) Braket Jupyter quantum computer environment - it would certainly be faster than Monte Carlo simulation!

✅ Lloyd, John and Terry presented MCPM to RADM Barrie West (Chief of Naval Materiel) and his project managers, and also to a large MTE public seminar in Sydney.

✅ MCPM simulation was supported in a 1986 report: Joint Committee of Public Accounts (JCPA) Review of Defence Project Management (243) - Recommendations 15 and 16 (paragraphs 4.21-4.23). The recommendation was accepted by Defence.

✅ MCPM is now incorporated into some advanced project management systems and is recommended by the Project Management Institute [📰 PMI Article: 2001].

😇 Acknowledgement: "The application of Monte Carlo simulation to risk analysis in project networks was developed by David G. Malcolm and his colleagues. This method, often associated with the Program Evaluation and Review Technique (PERT), was introduced in the late 1950s. Malcolm, along with John W. Roseboom, Charles E. Clark, and William Fazar, published their seminal work on this topic in the early 1960s" [ChatGPT].

Lloyd comments: We developed a network dependence coding structure and demonstrated the use of computer simulation for running large numbers of iterations on each activity in a large, complex project network. Our work identified all potential critical paths and assessed their probability of determining which were most likely to represent the ultimate critical path.

⚙️ Issue: Simulation, machine learning and artificial intelligence require a lot of processor power. Fortunately quantum computing, tensor processing units (TPU) and GPU stacks are now capable of supporting that demand. Techinvestment.com is an investor in both quantum computing and Nvidia GPU stacks.

🤔 While in the Office of the Public Service Board, Lloyd was asked by the Deputy Chief of Naval Staff (RADM Neil Ralph) to participate in a study led by an external consultant and CDRE Mal Savage with other senior naval officers, of Navy Office's capability to support the simultaneous introduction into service of new destroyers and Collins Class submarines.

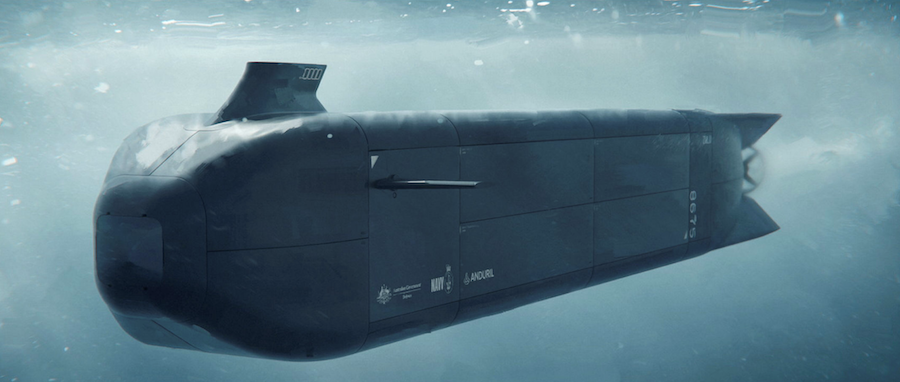

🔺 A Collins Class submarine in Port Philip Bay, Melbourne

DCNS' concern is relevant to the proposed acquisition and support of different types of submarine under the AUKUS Alliance. Australia is likely to buy a Virginia-class fast attack nuclear submarine from the US Navy - there's a suggestion that it may acquire 3 - however there is a question of need and affordability. From his DSMC experience, Lloyd would ask about the credible scenarios that might define the specification of an Australian Navy requirement for nuclear submarines.

AUKUS is expected to involve location of up to 4 USN Virginia-class submarines, one UK Astute-class submarine – and around 1,200 personnel based year-round at HMAS Stirling near Perth.

The AUKUS Alliance is at risk of being cancelled or reducing Australia's role to provision of a Naval base, despite having paid AUD800 million to USA in its second instalment under AUKUS:

- US Secretary of Defense for Policy Elbridge Colby stated last year that submarines were a scarce, critical commodity, and U.S. industry could not produce enough to meet American demand, and

- The Australian government has not explained how it would fund AUD 268 - AUD 368 billion for AUKUS over the next 30 years. The first budget surplus since 2007-87 was 5 years later: the 2022-23 FY with a surplus of AUD 22.1 billion and then AUD 15.8 billion (about 0.6% of GDP) in 2023-24.

- The “Sail-away” price of a Virginia-class sub: The latest U.S. Congressional Research Service (CRS) puts procurement of Virginia Payload Module (VPM-equipped) Virginias at ~USD 4.3–4.5 billion per boat (varies by block and year). That’s roughly AUD 6.5–7.0 billion at recent FX, noting AUD moves will shift this.

- The all-in “program” cost per boat (rule-of-thumb): ASPI advises total program cost (facilities, spares, training, support, etc.) typically runs ~1.5–2× the sail-away price. Using the CRS unit price above, a reasonable planning range is ~AUD 10–14 billion per Virginia over the initial acquisition/support phase (before full life-cycle sustainment).

- Then there are the cool "goodies" that can be added, such as a Dry Deck Shelter (DDS) for special forces (SEAL) use ⏯️.

The bottom line question is: can Australia afford to play the 'big boys' game (estimated Australian taxpayer cost: AUD 368 billion increasing Defence spending from 25 of GDP to 3.5%)? ... or should it learn from Canada's experience. Canada has decided to become less dependent on USA, with its announcement on replacing F-35 fighters with Swedish Saab Gripen E aircraft. So Donald Trump has announced the expiry of the Canada, US, Mexico Agreement (CUSMA) in 2026 ⏯️. Back to the point: Can Australia afford a fleet of nuclear submarines with an indefinite delivery schedule ... or something else?

Update 11 Dec 2025: AUKUS ministers considering reducing the AUKUS security pact.

Update 15 Dec 2025: National Security Strategy of the United States of America, November 2025

It's interesting to note that AUKUS is not mentioned in the Strategy, and Australia is only mentioned 3 times - mainly in relation to trade.

Update 11 Sep 2025: Australia plans to buy a fleet of "dozens" of "Ghost Shark" drones at a cost of AUD 1.7 billion. Ghost Shark is an Extra Large Autonomous Undersea Vehicle (XL-AUVs) that will provide Navy with a cost-effective, stealthy, long-range, trusted undersea capability that can conduct persistent and disruptive intelligence, surveillance, reconnaissance (ISR) and strike. Ghost Sharks are 5.5 metres long and weigh 2.7 tonnes. They are designed to operate autonomously for up to 10 days at a depth of up to 6000 metres, allowing them to conduct missions too difficult or dangerous for crewed vessels. Anduril. The XL-AUVs could work with Anduril's Lattice Mesh system for surveillance, command and control. Here's an example of how such a solution could be very effective for a low initial and operating lifecycle cost.

Developing, manufacturing, and fielding these systems at-scale within an operationally-relevant timeline will be essential to help in defending Australia’s immense maritime boundaries The drones would be built and maintained by Anduril. Anduril is at pre-IPO status as at 1 Sep 2025.

Source: Australian Department of Defence via Defence Post

🤔 Other projects conducted while in the PSB included:

🤔 In the Federal Department of Finance Lloyd worked on service-wide implementation of program budgeting (recommended in the 1976 Report of the Royal Commission on Australian Government Administration).

Lloyd spent so much time "in the field" on projects that his bosses didn't know who he was: he'd come back from an assignment to find someone else in his office, his gear in boxes in a store room, and someone saying: "Welcome to the Public Service Board, I'm your boss". It didn't help that most times Lloyd was in a Branch team meeting he'd be called out by one of the Board's Commissioners to discuss a current assignment or his next assignment - to the point that he stopped attending Branch team meetings.

Lloyd's last assignment in the public service was a secondment to the Defence Inspector-General's office. On completion of this 6-month assignment, Lloyd resigned to work in the private sector.

WORK HISTORY

National Service: RAAF and Army

🪂 Australian Army: 1 Army Air Supply Organisation (1AASO): Air Dispatcher, Parachutist (36 AD PL: now 176 AD PL, a sub unit of 9th Force Support Battalion).

⚔️ Department of the Navy ⇨ Department of Defence

Cost Accountant, Finance and Planning Division, Garden Island Dockyard (Sydney Harbor) - Department of the Navy. As the Dockyard's Cost Accountant, Lloyd established the costs for all dockyard work and services which were applied to all dockyard work orders, for reporting to Navy Office and cost recovery from US Navy and civilian ships using the dockyard during the Vietnam war.

At this time the Dockyard was modifying HMAS Melbourne to provide an angled flight deck for landing aircraft. [Why an angled flight deck?] It was also supporting the introduction of Perth-Class guided missile destroyers. The work was supported by a primitive but effective costing system (DYCOST) with data sent to Canberra as punched tape for processing on Honeywell H800 mainframes and hard copy reports sent back every week.

Lloyd also monitored dockyard statistics including wages staff levels and the cost of disastrous levels of industrial demarcation disputes and stoppages during the Whitlam years - the loss of work and income during stoppages caused many wages staff to leave, and dockyard production capacity crashed.

🔺 Garden Island Dockyard, Sydney. The ship is ⏯️ HMAS Sydney (former aircraft carrier) ⏯️ About Australia's aircraft carriers

Lloyd spent a weekend on HMAS Melbourne as it did post-maintenance engine trials near Nowra. HMAS Melbourne was famous for ramming and sinking 2 allied destroyers: HMAS Voyager (82 personnel killed) and USS Frank E Evans (74 personnel killed). Neither collision was the fault of HMAS Melbourne. ⏯️ Real Top Guns

⚔️ Work Study and Systems Design: Commissioned reviews of issues in civilian support to the Navy, including Navy Supply Depots, RAN Torpedo and Maintenance Establishment (RANTME), and RAN Missile Maintenance Establishment (RANMME) - in particular the management and maintenance of tail fins (housing the electronic guidance system) for Ikara missiles.

Department of Administrative Services: May 1978 - Oct 1980

💲 State Branch Accountant, Transport and Storage Division. Lloyd realised that his work to this point had no front-line experience in operational management. So this job filled that gap, with operational experience in "corporate" management, with secondments as manager of government passenger transport and manager of heavy transport (including dispute negotiation with unions). 🚛

Department of Defence: May 1980 - Dec 1982

Continuing projects - mainly opportunities for productive use of IT within Defence, Navy and RAAF.

Office of the Public Service Board: Jan 1983 - Jul 1987

Service-wide, departmental, program and strategic projects and assignments. These projects included promotion of corporate strategic planning and IT strategic planning throughout the public service. The PSB was closed around 1987.

Australian Parliamentary Staff

Presiding Officers' Coordination and Planning Advisory Group: Advisor to the President of the Senate, Speaker of the House of Representatives and Parliamentary Departments.

💲 Department of Finance: Jun 1987 - Jul 1989

Principal Finance Officer. Lloyd worked on the introduction of program budgeting in Federal Government departments.

In October 1987 Lloyd was at a week-long residential meeting of Department of Finance executives at UNSW's Graduate Management School at Little Bay. He had been following USA's twin budget and trade deficits and the behaviour of stock markets. On the Thursday he publicly predicted that a crash would happen within days. The following Monday, 19 Oct 1987, the US stock market crashed with widespread economic effects. Lloyd and a DoF colleague then correctly predicted the date and value of the bottom of the ASX index.

Department of Defence: Inspector-General's Office: Projects.

The Defence Inspector-General's Office was especially concerned about cost overruns occurring, and likely to occur on the Collins Class submarine construction project. When the submarines finally entered the water, there were concerns about breakdowns and excessive noise. On 1 Nov 2024 only one of Australia's six Collins Class submarines was fully operational.

🔺 A Collins Class submarine escorted by a tug boat to Port Melbourne

Project Management Contractor: Jun 1989 - Aug 1993

.

Lloyd's role was the development of a sizing and costing model for a proposed Defence logistics system. The model sized infrastructure from mainframes, midrange and other computers. The model predicted (and that prediction was later confirmed) that the cost of replacing existing supply systems was a larger and more expensive project than expected. A review of the SSRP by the Parliamentary Joint Committee of Public Accounts was critical of most aspects of the project, including its preparation for, costing, and capability to deliver the project.

SSRP Insight and Lessons Learned:

- Understanding of the requirement: There was very little understanding of what was to be improved or replaced. The Statement of Requirement should have been preceded by a joint Defence and selected contractor review of existing central and depot systems, with discussions between the contractor (including those responsible for developing the proposal), Defence strategists (and possibly representatives of each service: Army, Navy, RAAF).

- Cooperation between the client manager and the head of the contract team: There was a very evident "hands off" division of responsibility and relationship between the Defence management and the contracted team. The contract team was inadequately acquainted with the operational requirements and technical environment to be improved and the capability and performance improvements expected to be delivered by the implementation project.

- Turnover within the contracted project team, from the head of the team to the quality assurance manager.

Cost/schedule control using the US Defense Systems Management College's C/SCSC for the Radar Sensor Procurement Project (RASPP: 26 enroute and major airport sites around Australia) which was a component of The Australian Advanced Air Traffic System (TAAATS).

🔺 Radar Sensor Procurement Project management team. The model is of a PSR+SSR radar station

A key schedule problem for RASPP was that the Australian subsidiary (TRAC) of its French supplier of radar systems, Thomson

Radar Australia Corporation Pty Limited (TRAC), was overcommitted because it was also supplying radar systems to the Australian Navy's destroyer program. Lloyd asked the RADM in charge of that project how he was getting the TRAC resources he needed for his destroyers - his response: "we paid for the A-Team". Lesson: you get what you pay for!

In this project Lloyd identified the optimal and lowest cost location for the Sydney international airport radar sensor.

🔺 Optimal Radar Tower Location For Sydney International Airport

This required mapping all of the obstruction constraints at the airport to find the best unconstrained location. The original plan had involved construction of an expensive pier on the side of one of the airport's main runways.

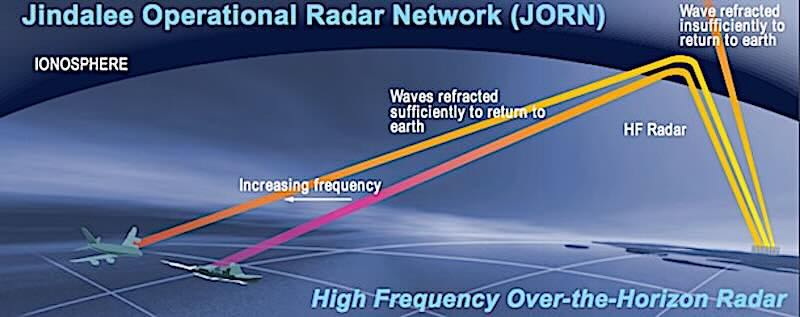

Jindalee Over The Horizon Radar Network

🔺 Jindalee Over The Horizon Radar Network

Telstra/Marconi tender for Phase 3 of the $1 billion Jindalee Over the Horizon Radar Network project. Lloyd's contribution to the Telstra/Marconi bid was project risk management (using Lockheed Missiles and Space methodology) - earning top score in this area of the tender evaluation. A key problem for Phase 3 was the unavailability of a sufficient number of programmers experienced in the software involved - this was identified in the risk assessment. Telstra was unsuccessful in Phase 3 for this reason. Underestimating cost, schedule and capability requirements for a high tech project is a common risk in projects like this.

☝️ JORN/OTHR update [Sep 2025]

⚔️ Defence Supply Systems Redevelopment [SDSS] project: Business case specialist in the prime systems integration team.

Lloyd's work included building a capacity planning model to determine sizing and costs of all viable alternative network design configurations for Defence supply management and all ADF supply depots. A key problem for this project was overcommitment of the Prime Systems Integrator: a fixed price contract - same problem as experienced in the above projects. However Lloyd's subproject, a costed business case requiring capacity estimation and optimisation for the whole Defence stores supply system, was delivered on schedule.

Lloyd joined ANZ Bank as a Senior Manager (later Chief Manager) Expenditure Review Group in Strategic Planning. ERG focused on capital expenditure (strategy implementation, systems development, acquisitions, property and equipment leases etc). Reporting directly to the Group Chief Financial Officer/Board Secretary: Lloyd provided independent advice to the Executive Committee and Board on approval and performance of about 500 major (>$1m) capital expenditure projects in Australia and globally. More often than not, project sponsors on the Executive Committee made the same mistakes as sponsors and bidders for the technology projects described above.

Around 1989, ANZ Bank entered into a five-year, approximately AUD 450 million sale-and-leaseback arrangement with IBM, under which IBM purchased all of ANZ’s technical infrastructure — including mainframes, mid-range systems, and desktop computers - without an inventory of assets transferred to IBM. 😳

The objective was to improve ANZ’s balance-sheet appearance (“window-dressing”) by converting owned assets into leased operating equipment, but the arrangement created significant operational risk. Shortly afterwards, the bank realised its vulnerability: ANZ needed to upgrade its mainframe, yet the system was technically owned by IBM, which limited the bank’s options and bargaining position.

Lloyd recommended that ANZ terminate the lease of the IBM mainframe and instead acquire a more powerful Amdahl mainframe, which delivered greater processing capacity at a much lower cost than IBM’s proposed upgrade. This decision materially reduced both the bank’s upgrade expense and its operational dependence on IBM.

In later years, ANZ again entered a major technology partnership with IBM — a five-year, roughly AUD 450 million infrastructure services agreement — under which IBM provided core systems hosting, mainframe, and emerging cloud capabilities.

ANZ had (and apparently still does have) many unmanaged potential and realised risks and cultural problems. Lloyd was happy to leave ANZ and join EDS the next business day.

After 5 years as a senior corporate executive Lloyd went back to project work with a major US technology company: EDS [Electronic Data Systems]: Aug 1998 - Mar 2001. For one of his projects (business process re-engineering) Lloyd developed a risk management assessment database (based on analysis of 500 BPR projects) - this was used each week for an assessment of risk issues in his BPR project. He also developed a project team management database for team timesheet (cost) and schedule (progress) management. His project was completed on schedule for 30% of its budget and accepted by the client.

This was a very difficult time, as technical staff became hard to get, and became more expensive (trashing project budgets and schedule targets):

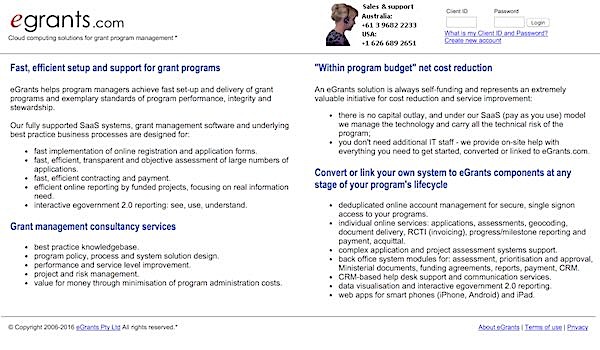

eGrants.com

There comes a time for building and running a business rather than continuing a life of contracting or employment in someone else's business. For some time Lloyd had been a contractor specialising in project management followed by 5 years as a senior executive at ANZ Bank, and then more contract work on an Australian Customs Service business process re-engineering (BPR) project. So in 2005 Lloyd identified an opportunity to build an IT services business: eGrants ... it started with Lloyd asking a potential client "do you have a spare desk and computer?" and eGrants was born, and delivering support the same day.

🔺 Lloyd Bunting: Founder, Developer: eGrants.com

🔺 eGrants.com design, development, maintenance and operation

eGrants supported programs distributing about $1 billion in funds to state and local governments and other entities, with "clean" assessments from the ANAO. At the time there were no government security standards for SaaS, so our system was certified against the PCI/DSS standard and audited for exposures and new threats daily by Symantec. Symantec's MSSP team would search daily for weaknesses in egrants security, and would require any weakness to be fixed within 72 hours. eGrants used automatic switching and data duplication (log shipping) for fail-safe data assurance.

✅ eGrants.com achieved a 99.5% user compliance rate and a 95% satisfied or very satisfied rating by users, and the grant program (our client) received a Minister's achievement award. eGrants.com was also used to accelerate the investment of grant funding into local government infrastructure projects at the depth of the Global Financial Crisis. Every schedule target was met: "if it's not impossible we're not being ambitious enough". This contract was a first for us (as eGov: our first $1 million contract) and the government (its first SaaS contract). eGrants supported grant programs from Sep 2005 to Jun 2010.

TechInvestment.com: Jun 2010 - Dec 2025

Lloyd's current focus is TechInvestment.com which manages an AUD 26.894 million [USD 19.126 million] portfolio of technology stocks (mainly artificial intelligence, GPU, TPU, LPU and quantum computing) listed on NASDAQ and NYSE exchanges.

During periods of market volatility TechInvestment.com also engages in day-trading in ASX-listed stocks.

TechInvestment.com (Bunting Pty Ltd) is an independent investment company: it has no external equity or debt - it is run by 2 great long term friends. Its growth is based on capital appreciation of its investment portfolio and reinvestment of dividends.

Retired Professional/Industry Memberships

These memberships were retired when Lloyd was unable to participate in CPD activities while building and operating businesses, working long hours on interstate projects and trading in NASDAQ and NYSE listed companies:

Current Industry Association

As an investor in NASDAQ and NYSE technology stocks, Lloyd's company, TechInvestment.com, is a member of the American Chamber of Commerce in Australia (AMCHAM)

😇 DISCLAIMERS, ETC

✋ Lloyd Bunting does not offer investment advice or investment services to the public.

✋ TechInvestment.com (Bunting Pty Ltd) does not offer investment advice or investment services to the public.